Intermap Technologies: mapping the world

This is one of the companies that I met in Las Vegas that looked rather interesting, which is why I’m presenting it today.

History

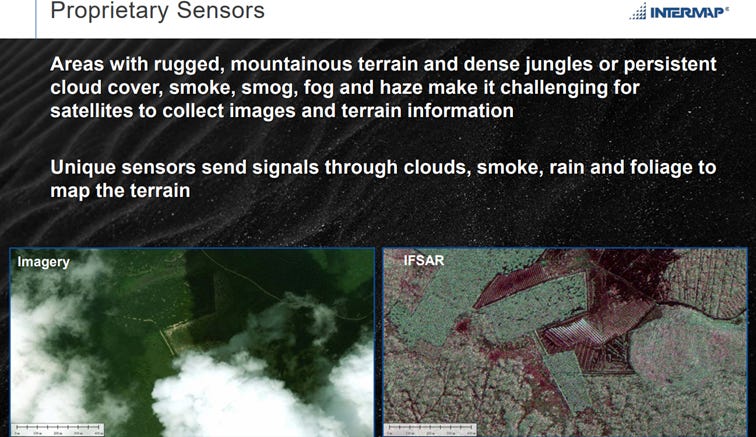

Intermap has a long history that goes back more than 100 years with one of its predecessor companies being the first to do aerial surveys for the US Army. They have a long history of doing aerial surveys, collecting data and making maps, often for governments. Before 1996 they were a part of Intera, but then Intera split up and the division of Intermap became an independent company that listed in 1997 on the Toronto Stock Exchange. With the split up Intermap had acquired the rights to a digital mapping technology IFSAR (Interferometic Synthetic Aperture Radar for Elevation), that was developed by the Environmental Research Institute of Michigan with funding from the US Defense Advanced Research Projects Agency (DARPA). That IFSAR is a very advanced radar technique that can be used to remotely (with sensors on planes or drones) collect data to map terrain. Intermap also has proprietary sensors that can send signals through clouds, smoke, rain and foliage, which gives them an advantage compared to other techniques. IFSAR is also relatively cost-effective compared to other techniques for data collection over large areas, which allowed Intermap to build out a business doing these type of surveys for governments and over the years also finding more and more commercial applications for the data they collected.

What do they do?

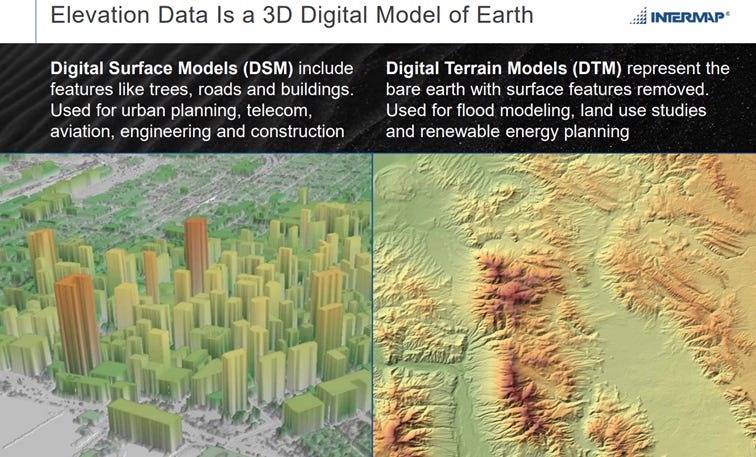

Intermap collects, processes and analyzes 3D data. Over the years they have developed a digital global library (NEXTMap) from doing several national or regional mapping programs for governments and they now have basically mapped most of the world. The nice thing is that they own the data and can license it out multiple times to different customers. The data can be used to make a couple different types of digital elevation models: (1) Digital Surface Models(DSM): digital representations of the earth’s surface, including all buildings and trees on it (2) Digital Terrain Models (DTM): basically the “bare earth” with all vegetation and buildings removed. This is also called the foundational data, on top of which layers of other data can be put. (3) Orthorectified Radar Images (ORI): radar images that have been geometrically corrected to remove distortions caused by terrain, so that they are ready for analysis.

These models can be used to produce three different types of income for Intermap:

Data Acquisition & Production: collecting data with their IFSAR-equipped aircraft and then processing it to generate DSMs, DTMs or ORI. They are used for things like mapping, urban planning and risk assessment. The big mapping programs for governments are the most important part of this income stream.

Value-added Data: combining their own elevation and image data from their database with other data sources to make new data sets that fit a customer’s specific application. These products can be licensed to customers as a one-time project or as repeat business. An example of this is a contract with the US Airforce where they combine their own geospatial data with other data (satellite, LIDAR,…) to develop a navigation solution for areas where GPS signals are unavailable or unreliable.

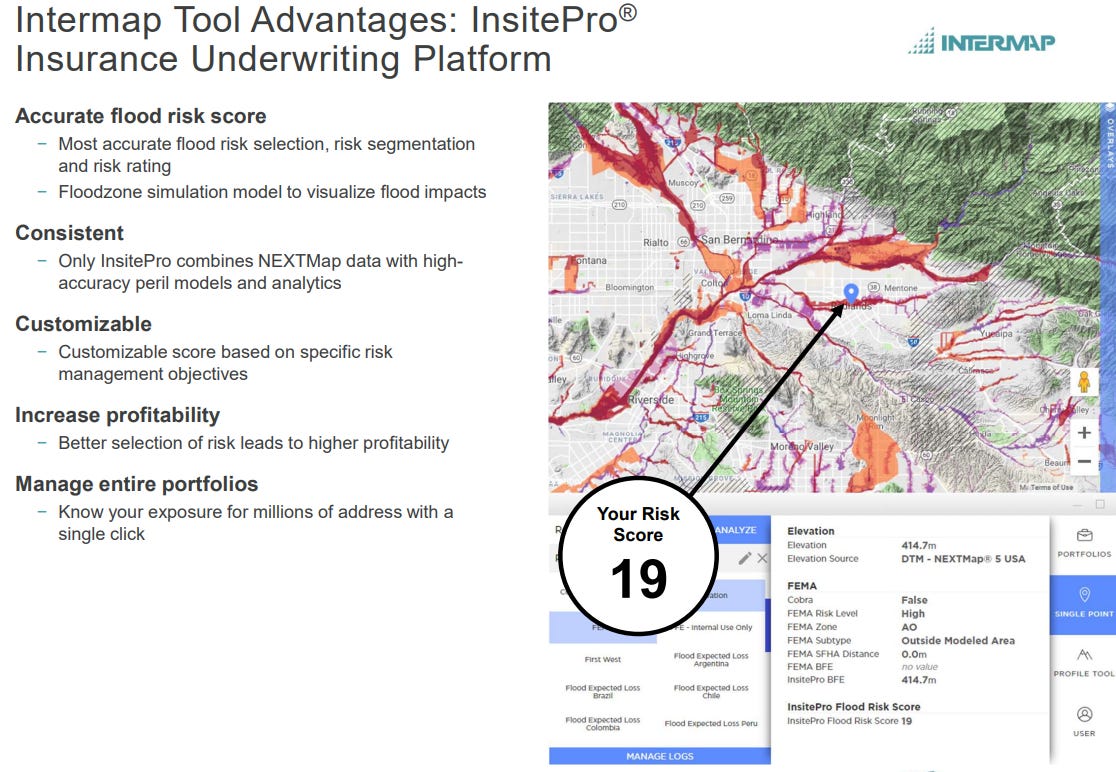

Data-as-a-Service: licensing software on annual subscriptions, which generates recurring revenue. An example is InsitePro, a software package for insurance underwriting that combines Intermap’s elevation data with third party data to make an assessment of natural catastrophe risk of specific locations, helping the insurers make informed decisions. Today more than 60 insurers already use InsitePro.

Financials & Valuation

All numbers are in US dollars, unless otherwise indicated

Toronto: IMP

Share price: C$ 3.14

Number of shares: 59.1 M

Options: 1 M

RSU: 3.8 M

Warrants: 3.4 M

Number of shares fully diluted: 67.3 M

Market cap: C$ 186 M or $ 135 M

Cash: $ 7.4 M

Debt: $ 1 M

Enterprise value: $ 129 M

Intermap had lumpy revenues over the years, mostly because big mapping projects for governments made up most of the revenues, but demand for that type of projects fluctuated over the years. In 2015 they won a huge $ 175 M contract to make a 3D map of the Democratic Republic of Congo. They took on a lot of debt to fund the preparation of the program but due to the political instability in the country the contract was first postponed and then cancelled. That left them in a bad financial situation which led to management and board changes. Patrick Blott, who had a background in the sector, was brought in as chair of the board and later as ceo by the lender, Vertex, to fix things. Costs were cut, and a settlement for the debt was eventually reached in 2020. In 2019 Blott bought the shares that Vertex owned and in this way became the largest shareholder. He has since bought more shares and now own roughly 11% of the shares outstanding. In my interview with him in Vegas he gave a good impression, smart and motivated, the kind of person you would want to run your business as a shareholder.

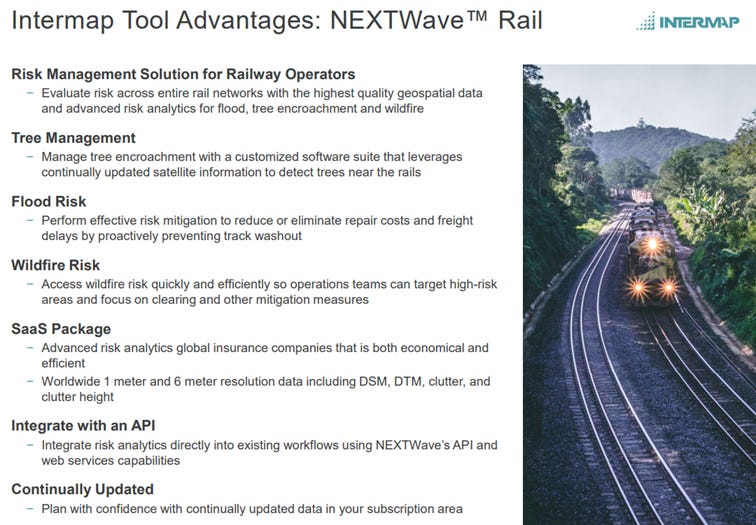

The past years Intermap has focused on become less dependent of the big mapping projects for governments, and has developed several products for commercial applications. Their biggest commercial vertical today is insurance, where more than 60 insurers use their software for catastrophe risk modeling. The two other important verticals are communication and navigation (examples: they supply data for Waze, they have a solution for train operators to manage tree encroachment). The interesting thing about these commercial contracts is that they are usually on multiyear contracts, so recurring revenue, with higher margins. Usually the contracts also have usage caps, which means they can charge extra on increased usage. These contracts are also very sticky, with a minimal (1-2%) churn rate.

In the last couple of years Intermap has also won a couple of new contracts with the US government, including the US Airforce and the National Geospatial Intelligence Agency (NGA). These programs create frequently updated elevation data sets that are used for high-priority national security areas of interest. One of the Air Force programs for instance is to provide the elevation data to develop a navigation system that can operate without GPS, so aircraft can navigate safely in areas where GPS signals are jammed, which is becoming more common in the current electronic warfare. The advantage of these programs is not only the revenue that they bring, but that the government funds part or all of the development and that Intermap can also use what they learn through these programs and adapt it for commercial use.

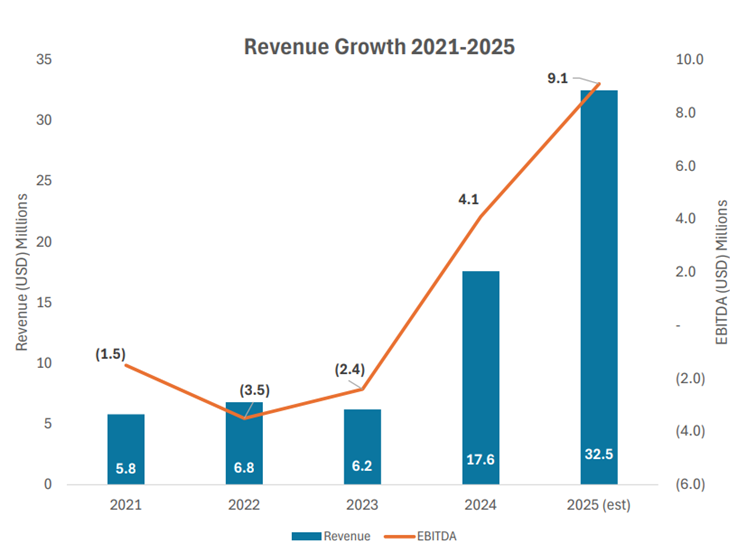

The increasing commercial applications and the recent new programs with the US government have given Intermap’s revenue numbers a big boost in the last couple of years: revenue went from $ 6.2 M in 2023 to $ 17.6 M last year and is expected this year to get to between $ 30 and 35 M. The big jump last year also has to do with an important $ 20 M contract they won in Indonesia to map 1/10 of the country. Half of that contract was executed last year, the other half will be in the results this year.

More important is that that $ 20 M contract was only phase 1 of a government plan to map the entire country. The second phase, to map the other 90% of the country, is worth $ 180 M and is expected to be awarded somewhere in the next two months. As the incumbent, and having won the first contract, chances are very high that Intermap will also win the big $ 180 M contract this year. That contract would be executed of 4 years, so roughly $ 40 M extra revenue per year for Intermap, so in 2026 revenue could go to $ 55 to 60 M and even a bit higher in 2027/2028.. With rising revenue they are getting operating leverage and margins are increasing: EBITDA-margin was negative in 2023, 23% last year, and management is guiding for 28% this year. If they reach $ 55 to $ 60 M in revenue next year, then C$ 0.3 earnings per share are achievable, which would make the shares now trade at roughly ten times next year’s earnings, which seems too cheap to me.

Risks

The biggest risk is of course that Intermap doesn’t get the $ 180 M Indonesian contract, if that happens then the big growth won’t come and the stock would probably go down (a lot). I think chances of that happening are low, but not zero. In general there is also customer concentration risk, if they for some reason lose their good relationship with the US government, then that would have a big impact on their results.

Another risk would be if other technologies become better and/or cheaper in the future, making Intermap’s IFSAR less interesting.

Key man risk: ceo Blott is the driver behind Intermap’s turnaround and growth in the past years, and he is also the biggest shareholder. If something were to happen to him, or if he decided to leave the company, that would be a big loss for Intermap.

Conclusion

Intermap is an interesting company with a rather unique technology and database that makes them dominate the market for large scale 3D models. They are increasingly finding more commercial applications for their data that add recurring revenue. The new big Indonesia contract should give their revenue and profit a big boost in the coming years, and even after the big rise of the share price in the past year, I don’t think this is yet fully reflected in the share price. Catalysts in the near term could be the award of the big Indonesian contract, and an uplisting to a bigger U.S. exchange, which management says is still the plan for this year.

Disclosures / Disclaimers: I own shares of Intermap Technologies . This blog is for informational and educational purposes only. This is not a solicitation to buy or sell any stock. Nor should it be seen as an endorsement of any particular investment or opinion of the stock’s current or future price. To be clear, I do not encourage or recommend for anyone to follow my lead on this or any other stocks. I am not a financial advisor. Please do your own due diligence.