Litigation Capital Management: there's money in litigation

History

Litigation Capital Management (LCM) was founded in Australia in 1998 and was first listed on the Australian Securities Exchange (ASX) in 2016. Later they expanded to Europe and opened offices in Singapore and London and then in 2018 moved its listing to the AIM exchange in the UK. Current ceo Moloney joined the company as a director in 2003 and became ceo in 2013. He owns almost 9% of the outstanding shares.

What do they do?

LCM was one of the pioneers in litigation finance. In litigation finance a company funds a legal claim in exchange for a share of the proceeds from that claim or a multiple of the invested capital . The multiple or percentage also rises over time, sot hey are not negatively affected if cases take a long time to get resolved. If they lose the case, they don’t get any compensation. They typically finance large commercial disputes or class actions, they don’t do personal injury or matrimonial disputes or other cases that have emotion in it.

Cases are sourced mostly by forming relationships with law firms and insolvency practitioners. Since inception they funded 260 disputes and they’ve had a loss in only 13 cases, so only in 5% of the cases.

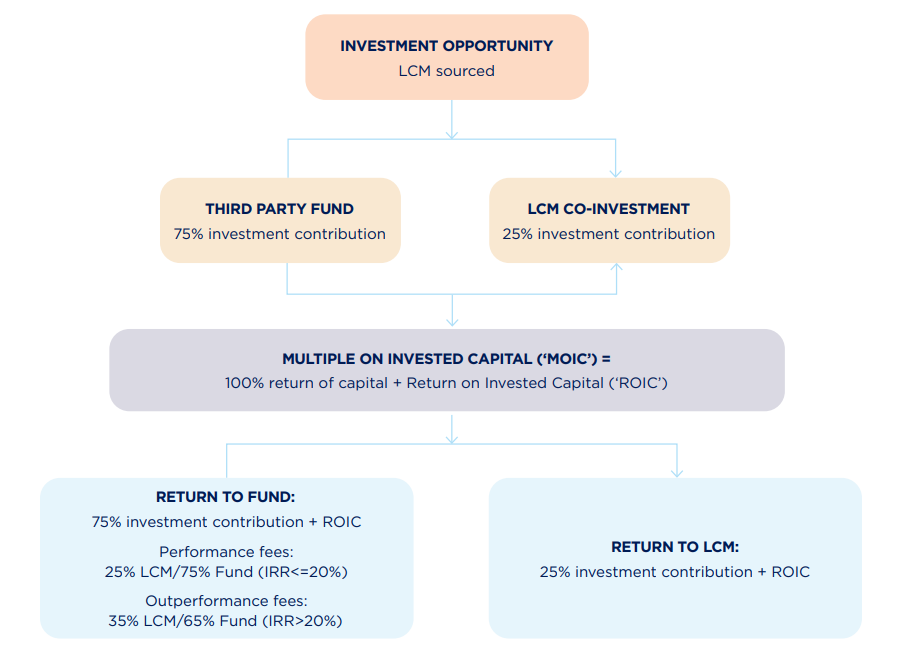

A case takes on average 29 months before conclusion, in the future they think this will increase to 36-42 months in the future as they are taking on bigger and more complex cases now. Since LCM has to prefinance all the costs and only gets rewarded in the end, the business is capital intensive. To solve this, LCM started looking for external financing and in 2020 launched their first investment fund (Fund I). External investors finance 75% of the costs and LC% 25% and LCM gets the return on their 25% plus a performance fee if the IRR of the case is above 20% (which it usually is). So not only can they grow faster this way, they also make more money on the cases through the performance fees. Fund I closed at US$ 150M in 2020, last year they started Fund II, that recently closed at US$ 291M.

Financials & Valuation

All numbers are in Australian dollars, unless otherwise indicated

AIM: LIT

Share price: £ 1.02

Number of shares: 106.6 M

Options: 14.7 M

Number of shares fully diluted: 121 M

Market cap: £ 109 M

Cash: $ 83 M

Debt: $ 69 M

Enterprise value: £ 102 M

The past couple of years have been influenced by COVID, with courts shutting down in a number of countries and/or working more slowly. This impacted LCM because cases took longer to get settled or resolved, impacting revenue and cash flow. Now that the impact of COVID is starting to fade away and courts are working normally again and the backlog in cases is diminishing, we should start to see LCM’s revenue numbers grow again. On top of that, the asset management through the funds that they started in 2020 should now be getting up to speed and accelerate in the coming years. We already saw the first signs of that happening in the FY 2023 (ended June 2023) numbers with income from the resolution of investments jumping from $ 47.2 M to $ 84.2 M and the cash position rising from $ 29.3 to $ 83 M . The improving balance sheet and better cash position also made the company decide to start paying a dividend of 2.25 pence per share. Results are lumpy and the returns can vary wildly from case to case, but on average in the past 12 years they’ve made a return of 1.78x their invested money on a case and achieved an average IRR of 78%. Those numbers should further increase as they do more cases through their funds.

It's difficult to get an exact idea of what their profits could be in the coming years because of the lumpiness of results, but if we look at the earnings per share they made in the past two fiscal years (ending June 30), it was 15.5 p and 17.2 p, which means that at the current share price the stock is trading at a price/earnings ratio of less than 7. With growth accelerating and returns rising in the coming years as their asset management business grows, I think annual profits should be able to grow on average at least high double digits and potentially much more. If they can achieve that, then I would also expect the p/e multiple to expand, which would further increase shareholders’ returns. Management also thinks the share price is too low and the company is undervalued, with the FY 2023 results they announced that they would start a $ 10 M share buyback program.

Risks

LCM used to use cost accounting, which is conservative, because it only shows revenue from a case when the case is closed and the amount LCM receives is final. Another type of accounting is fair value accounting, which some of its competitors like Burford use, which also books unrealized profits at key milestones in the process. The risk with this type of accounting is that your profits grow faster than your cash flow, and that in theory companies can abuse this method to make their numbers look better. This is what led to a short report on Burford a couple of years ago, where shorter Muddy Waters claimed their level of unrealized profits was exaggerated. This caused the share price of Burford to nosedive and put the sector in a bad spotlight. Now, a few years later it turns out that Burford wasn’t too optimistic, but it still makes some investors avoid the sector, because it is a bit of a black box, and as an outside investor you can’t really assess if those unrealized profits are realistic or not, you have to trust management. The reason I’m mentioning this is because after a review of their accounting approach LCM has recently decided to also start using fair value accounting, based on achieving milestones in their cases, because it gives a better indication of the progress they are making in those cases. While this is understandable, and it would give investors more details on the progress, it will also cause a growing gap in the coming years between reported profits and cash flows.

Another risk is key personnel risk. This is a people’s business and hiring and retaining the right staff with experience and knowledge is crucial for the business. LCM has a small staff of 22 people, and there’s always the risk that some of them get poached by bigger competitors like Burford or decide to leave LCM and start on their own. So far it’s mostly been the other way around, because LCM has attracted some people from their bigger competitors in the past years, but this can always change in the future.

Competition in general is a risk, not just for personnel, but also for cases. If more competitors enter the field, or existing ones aggressively expand, then it could become more difficult for LCM to source enough attractive cases. If that happens, then we could see returns on future cases go down. I think this risk can be countered by the fact that it is a specialized business, and I think that reputation and track record matters, so it won’t be that easy in the future for newcomers to compete with established players like LCM, but it’s not impossible. LCM’s latest comments indicate that the past year competition has been decreasing, with some companies exiting the business.

Regulatory risk: in the UK there was a recent ruling from the Supreme Court that decided that in the future the return for litigation finance can no longer be calculated as a percentage of the awards in favor of the funded party. This doesn’t really affect LCM, because most of their cases in the UK they get paid a multiple of the invested capital. Other legislation in the future that might limit the use of litigation finance in other countries could have an negative impact on LCM, if it were to happen.

Conclusion

LCM is an interesting little company that is operating in a niche of the financial world. Their decision a couple of years ago to also start funds for external money and receive fees as the manager of those funds, should lead to strong growth and rising margins in next couple of years. At today’s valuation the stock market is not reflecting this expected growth. I therefore think that as LCM demonstrates this growth acceleration in the coming quarters and years, the stock has a good chance of undergoing a big rerating. This reminds me of what Mohnish Pabrai would call a “heads I win, tails I don’t lose much” type of investment. There are of course also risks, the biggest being increasing competition that could drive down returns, and like insurers and banks, it has some “black box” characteristics, because as an outsider you don’t have a view of how the court cases are going, but I think the management can be trusted and they also have skin the game as shareholders, which is a plus.

Disclosures / Disclaimers: I own shares of LCM. This is not a solicitation to buy, sell, or otherwise transact any stock or its derivatives. Nor should it be construed as an endorsement of any particular investment or opinion of the stock’s current or future price. To be clear, I do not encourage or recommend for anyone to follow my lead on this or any other stocks, since I may enter, exit, or reverse a position at any time without notice, regardless of the facts or perceived implications of this article. I am not a financial advisor. Please do your own due diligence.