M-Tron Industries: undiscovered little gem with several tailwinds for the coming years

History

M-Tron is headquartered in Orlando, Florida and has a history of more than 50 years (since 1965), but for most of that time it was a division of another company, LGL group. M-Tron was spun off from LGL in October 2022 and therefore only has a very short history as a listed pubic company and is not yet well known by most investors. LGL shareholders received half a share of M-Tron for each share they held, and LGL now holds no more shares of M-Tron.

What do they do?

M-Tron designs, produces and sells radio frequency (RF) components and solutions, essentially products that are used to control the frequency or timing of signals in electronic circuits. They make oscillators, filters and resonators. M-Tron’s products are built for harsh environments and are very shock and vibration resistant, which makes them well-suited for the very demanding applications in the defense business, which is their largest end market.

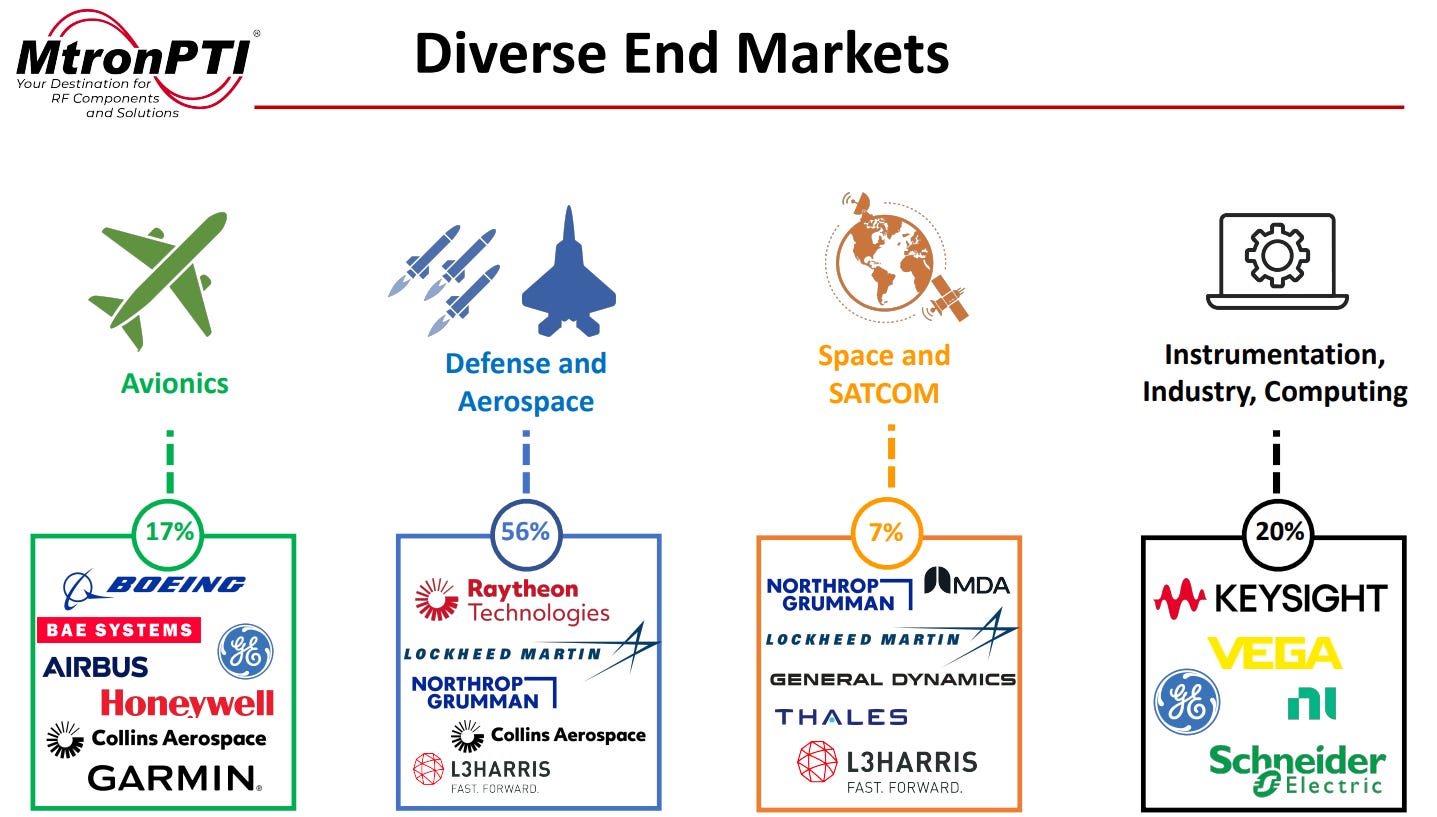

56% of their sales are in Defense and Aerospace with large defense companies like Northrop Grumman, Raytheon and Lockheed Martin. Their components are mostly used in radars, electronics of missiles and electronic warfare (think of disrupting or jamming radar or infrared signals).

The second biggest market with 20% of sales is Instrumentation, Industry and Computing, where they make a range of high performance filters and oscillators. The third biggest market with 17% of sales is Avionics, where they provide rugged, proven, reliable clocks, oscillators and filters in numerous applications from flight control to navigation (see picture below).

The fourth and smallest market today (7%) is Space, where their products are mainly used in satellites.

Most of their customers are won through a long sales cycle where a potential customer puts out a request for a new program, then M-Tron usually works together with the customer’s engineering team in the design phase of the product, makes a prototype and if they qualify and are chosen, then they can start producing once the customer starts his own production. They will then usually get reorders for (5-10) years to come. M-Tron likes to focus on markets where design wins tend to be sticky and program life cycles long. This is especially true in Defense programs, where for instance for the Tomahawk missile program can run for 20-30 years.

M-Tron has grown sales at around 7% annually in the past couple of years, but growth is now accelerating and there are reasons to assume that it will further accelerate in the coming years. The defense sector has a tailwind in the coming years with the war in Ukraine depleting stocks of missiles and other materials, which should lead to increased production in the coming years at M-Tron’s customers. On top of that tailwind, the US military is going to do a large upgrade of the electronics on its planes, ships and vehicles in the coming years. This upgrade should give demand for M-Tron’s products in things like radars and jamming equipment an extra boost. The Space division is the smallest segment, but it is also growing fast and the number of satellite launches seems to be accelerating. In Avionics the expected increase in the worldwide fleet in the coming years should also give growth in that division an extra boost. These tailwinds are already beginning to show up in the numbers: M-Tron’s backlog in the past year roughly doubled to $ 46 M.

M-Tron was responsible for more than 90% of LGL’s business, so it’s not surprising that ceo Ferrantino and cfo Tivy also moved to M-Tron with the spinoff. Ferrantino has an engineering background and had worked in leading roles in the electronic components business for a number of years when he joined LGL as a director in 2019, in 2021 he became ceo. Chairman of the board is Marc Gabelli, son of famous investor Mario Gabelli. Together Mario and Marc Gabelli own 24% of the shares.

Financials & Valuation

All numbers are in US dollars

NYSE: MPTI

Share price: $ 10.85

Number of shares: 2.68 M

Options: 0.01 M

Number of shares fully diluted: 2.69 M

Market cap: $ 29 M

Cash: $ 0.9 M

Debt: 0

Enterprise value: $ 28 M

In 2022 revenue was $ 31.8M compared to $ 26.7M in 2021 (+ 19%). Operating income rose from $ 2.11M to $ 2.88M (+ 36%). Earnings per share rose from $ 0.59 to $ 0.67 (+14%). Inflationary cost pressures and one-time costs related to the spinoff weighed on margins. Some long-term contracts make it more difficult for MPTI to raise prices immediately, so there is a delay now, but there should be more price hikes and a recovery in margins this year. The tailwinds are already reflected in a rising backlog and faster sales growth in 2022, and this should continue this year and the coming years. With margins recovering and sales of maybe $ 36-37 M this year, I think M-Tron can get to $ 0.85-0.90 earnings per share. In 2024 they could get $ 40M in revenue and earnings per share of more than $ 1. At the current share price the company is trading at 10 times my expected profit for next year, and that seems too low for a company that is expected to grow double digits for several years to come. My estimates are likely conservative and M-Tron could do better if the electronics upgrade of the US military goes faster than I think and/or if other NATO countries step up their orders for military equipment from the big US players in the coming years.

Risks

There is a customer concentration risk: in 2022 their biggest customer was responsible for 25.7% of revenue, and the top 4 for 53.8%. In 2021 those numbers were 29.4% and 62.3%. These are the big defense companies like Lockheed, Raytheon and Northrop. Losing one of those big customers would be a big hit to sales, but that risk doesn’t seem very high as they have been customers for decades and they have actually been eliminating their RF divisions in the past years and relying on M-Tron to do the engineering. So those customers are more dependent now on M-Tron, which makes their switching costs higher.

Supply chains problems caused by COVID hampered their operations in the past two years, those problems are now going away, but they could always resurface with a new pandemic.

The tight labor market in the US is making it difficult for M-Tron to retain and attract employees, although the company indicated that recently the market is improving a bit.

If inflation remains elevated for a longer than expected time, then this could continue to weigh on M-Tron’s margins.

A part of the growing backlog is also customers ordering more to increase their supplies because of the supply chain problems. If this normalizes then the order book could go down, but management claims that this was only a small part of the increase in the backlog the past year, most of the increase would be market and customer share gains.

Conclusion

M-Tron is a recent spinoff , but a company with a long history. It has a good reputation and a strong market position in some interesting niches. They were a steady slow grower in the past, but now with some tailwinds (mostly in the defense industry) growth is starting to accelerate, and should continue in the coming years. As they grow bigger, margins should also expand as they have significant fixed costs. I think there’s a good chance they can grow their sales in double digits in the coming years, and with expanding margins profits should grow even faster. At the current valuation those positive expectations for the coming years are not reflected in the share price. I expect this to change as they continue to execute in the coming quarters and years, and then the stock should see a rerating.